Governor Blocks Mobile Bank App Bill Linked to Gay Murders

New York Gov. Kathy Hochul vetoed a bill to better protect mobile bank app users, which was prompted by the murders of two gay men.

Governor Kathy Hochul vetoed a mobile banking app security bill that was motivated by the murders of two gay New Yorkers.

The Financial App Security Act would have required mobile banking applications like Zelle, Venmo, and CashApp to require the use of a Personal Identification Number (PIN) when a user made any transaction exceeding a monetary limit of their choosing.

The bill also would have required a PIN before making any payments to another user whose account was created less than 24 hours before the transfer, any payment transactions beyond three made within the same hour, any attempt to sign into the service using a new or unrecognized device, and any other situations that indicating fraud. Most financial institutions, including official banking websites, already have similar, though not identical, security measures in place.

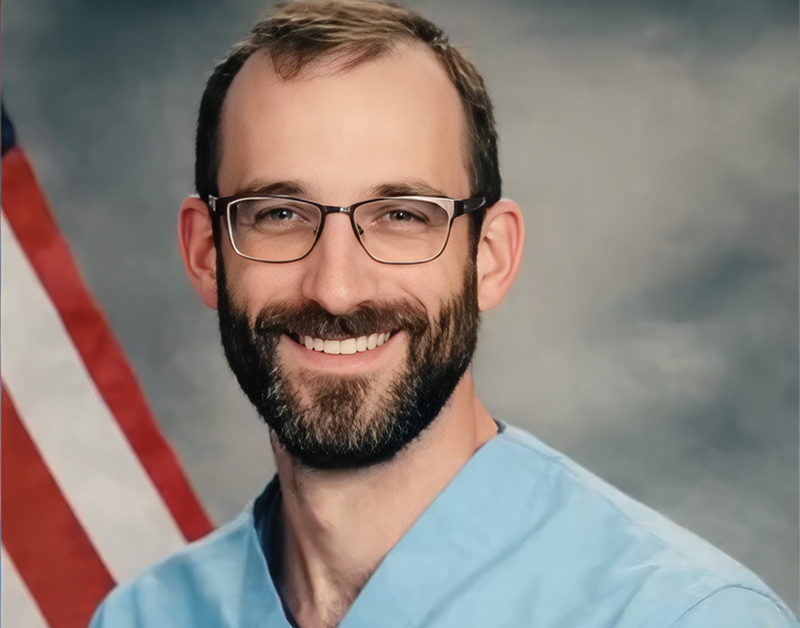

The sponsors of the bill, State Sen. Brad Hoylman-Sigal (D-Manhattan), a gay man who represents the West Side of Manhatten, including Chelsea and Hell’s Kitchen, and Assemblymember Grace Lee (D-Manhattan), who represents the Lower East Side, were inspired to draft the legislation in response to the 2022 deaths of two gay men, Julio Ramirez and John Umberger.

Both Ramirez and Umberger were drugged and robbed of thousands of dollars through electronic apps using facial recognition software that accessed their bank accounts.

Patrons of LGBTQ bars and non-LGBTQ bars were victimized in identical schemes, which were being carried out by multiple gangs who realized how to exploit mobile banking app security features and access victims’ financial information while they were incapacitated.

Proponents of the bill believe that requiring the use of a PIN could have prevented many of the victims from being robbed.

“This bill was inspired sadly by the deaths of two men in our Senate district, who were the victims of heinous violence,” Hoylman-Sigal told Hell’s Kitchen-based website W42ST.

“And the motive was clear. The perpetrator drugged them and drained their bank accounts, and did so because they knew that these financial apps like Zelle are notoriously porous and easily accessible. We think the corporations that own and operate these apps have a responsibility to limit fraud on their platforms, and we don’t think they’re fulfilling that responsibility at the moment.”

The bill was supported by Manhattan District Attorney Alvin Bragg, who penned letters to Zelle, Venmo, and CashApp urging them to add additional safeguards for consumers.

In her veto, Hochuls argued that requiring apps to include PINs for security “would mandate the use of onerous banking security measures, commonly utilized by the largest financial institutions.”

In her veto memo, the governor, a Democrat, wrote, “This legislation includes requirements that conflict with Department of Financial Services banking regulations and other technical challenges that could hinder compliance and unnecessarily restrict users’ access to these widely-used applications.”

Following the legislation’s unanimous approval in both chambers of the legislature, a tech lobbying group, Chamber of Progress, urged Hochul to veto the bill, claiming it would “expose consumers to increased financial fraud and economic hardship.”

As has become all too common for elected Democrats in recent years, Hochul sided with the lobbyists and financial institutions.

Hoylman-Sigal said he plans to reintroduce a new version of the bill next year.

“I can’t understand why common-sense security measures are viewed as onerous when every major financial institution, with the exception of these apps, uses them,” he said. “Our fight is not over. We are going back to the drawing board, talk to the opponents, but also continue to raise the alarm about the lack of security and responsibility on the part of companies that operate these peer-to-peer mobile apps.”

Lee was more blunt in her assessment of the governor’s actions.

“The bank lobby killed this bill, but I won’t back down,” Lee wrote on X. “I’ll keep fighting to put the safety of New Yorkers above corporate interests.”

Linda Clary, Umberger’s mother, expressed disappointment at the governor’s veto.

“New York has a chance to lead the country on this legislation and protect citizens,” she told Gay City News in a statement. “It is disappointing the governor chose to veto this effort to protect citizens. It would have been a step in the right direction and a chance for New York to lead.”

Support Metro Weekly’s Journalism

These are challenging times for news organizations. And yet it’s crucial we stay active and provide vital resources and information to both our local readers and the world. So won’t you please take a moment and consider supporting Metro Weekly with a membership? For as little as $5 a month, you can help ensure Metro Weekly magazine and MetroWeekly.com remain free, viable resources as we provide the best, most diverse, culturally-resonant LGBTQ coverage in both the D.C. region and around the world. Memberships come with exclusive perks and discounts, your own personal digital delivery of each week’s magazine (and an archive), access to our Member's Lounge when it launches this fall, and exclusive members-only items like Metro Weekly Membership Mugs and Tote Bags! Check out all our membership levels here and please join us today!

You must be logged in to post a comment.